I spoke with Stephanie Martin, senior vice president of Global Supply for Vexos, about the current state of the electronics industry from an EMS perspective. In Stephanie's view, the electronics industry is undergoing a continuous technological change as it moves towards smaller case sizes, and she detailed why users are interested in the design cycle of products and choosing as small a component as possible.

Nolan Johnson: Stephanie, when we discussed the parts shortage earlier this year, we learned a lot from your perspective. You have analysed some important global issues in depth. What has changed in the electronics industry this year?

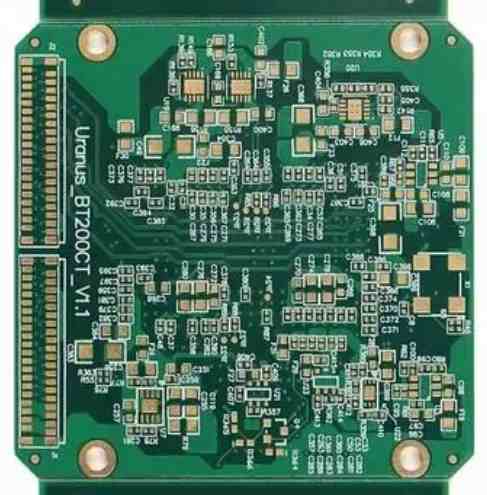

Stephanie Martin: The whole market has changed a lot this year. From December 2018 to last year, we were in a super cycle of product shortages and very long lead times. MLCCS are out of stock for 52 weeks and some suppliers are not even taking orders. They are very stingy in supplying MLCCS, so everything to do with ceramic capacitors is supplied on a quota basis, and we have a large number of these components. Longer delivery times and higher prices; This is a very bad situation. I have been in the electronics business for over twenty years and I have never seen a worse situation from a purchasing perspective.

Mainstream technology is moving to smaller components, much like the shift from lead to RoHS in the early 2000s, creating constraints on the market. This is a technological shift, so the size of components in electronic products will not increase. They will continue to go down the road of miniaturization, and most users will only have a very short time to complete the technology switch before small components are widely used, perhaps only two to three years; As a result, most users move into grey areas or restricted parts. Users will have to redesign those parts, or they will experience long lead times and high prices, which are caused by 5G infrastructure.

Johnson: With the exception of availability adjustments, we seem to be in the same position as we were in early 2019, responding not by increasing manufacturing capacity but by changing component requirements.

Martin: That's true. Manufacturers have been limited in their ability to make parts with smaller casings, small parts like MLCCS, in general because of the increasing use of these parts in the automotive industry that uses them. The mobile phone industry and the auto industry are both driving demand for these components. For example, there may be as many as 30,000 MLCCS in a typical electric vehicle. There are over 1,000 MLCCS in an iPhone X. If demand and production of cars falter (China is a major user of electric vehicles), then availability issues loom large. At the same time, manufacturers' capacity to make smaller parts (0201 and smaller parts) has increased by 10-15%. They all solve their problems eventually. The real problem is that industrial, medical and defense users need products that are designed for longer cycles and use larger parts. Production capacity for these components cannot keep up. Any type of component, as long as it uses a small size of components, and use a relatively large amount, will create pressure on the market.

Johnson: It certainly changes the layout design of the product and sends a warning to those who are designing the product or maintaining the product design to keep an eye on the parts they are using and, where possible, to redesign the product to use the parts on the Bell curve early on.

Martin: Yes. That's what I tell my clients when I meet them. Otherwise, you're just going to let the industry fall back on the larger parts. With their design cycle, we might get down to two or three years, and then the whole market will change dramatically. If they design to a smaller component size, they run into problems; Purchasing is restricted, with limited or no options, and more expensive. There is no sign yet of a return to the larger parts, mainly because they are what we call "general-purpose" or "popcorn" parts. Over the years, they've gotten cheaper and cheaper, so the average selling price is very low, and manufacturers are making very little profit on these parts, so they're abandoning these lines and making more profitable products. In the case of MLCCS, the materials they used to make the 1206 gauge housing can make up to 300 0201 gauge MLCCS, and the average quoted price per unit component is higher than the cost of a 1206 gauge component. Over time, once profit levels fall below this level, manufacturers do not continue to invest in capacity for large components; From the manufacturer's point of view, the same parts space, 0201 MLCC revenue is more than 300 times the 1206.

Johnson: No more big parts?

Martin: No. The only large parts that will remain are those with high voltages, because so far they have not been able to get the capacitance they require; Note that "so far" is key. The capacitors of small size MLCC components are currently not large enough to meet the requirements of high voltage components. Parts over 100 volts are still large in size, but if the voltage is only 50 volts or less, you can get larger capacitance with smaller parts, so manufacturers are gradually switching to smaller parts and moving into volume production. There will always be some suppliers that produce parts with larger specifications, but there are fewer of them, delivery times are longer, and prices are rising because these parts become more specialized goods.

Johnson: How is Vexos? What is your view of the market from a business perspective?

Martin: We're doing really well and the business continues to grow. We add new clients on a regular basis, and our focus is on designing services and providing information, as I've shown you. As is standard practice, we analyze the health of the client's bill of materials. We tell them the life cycle of the components in their bill of materials. We tell them what the problems are with the MLCC they are going to purchase, whether it's short term or long term, and that's what sets us apart from other manufacturers. Our business is growing very fast. They are still in planning mode because most of the business pressure is coming from buyers. I'm not saying it's a buyer's market, but it's very close to being a buyer's market again.